sales tax calculator anaheim

3 beds 25 baths 2060 sq. Calculator for Sales Tax in the Anaheim incorporated.

How Much Tax Do You Pay When You Sell Your House In California Property Escape

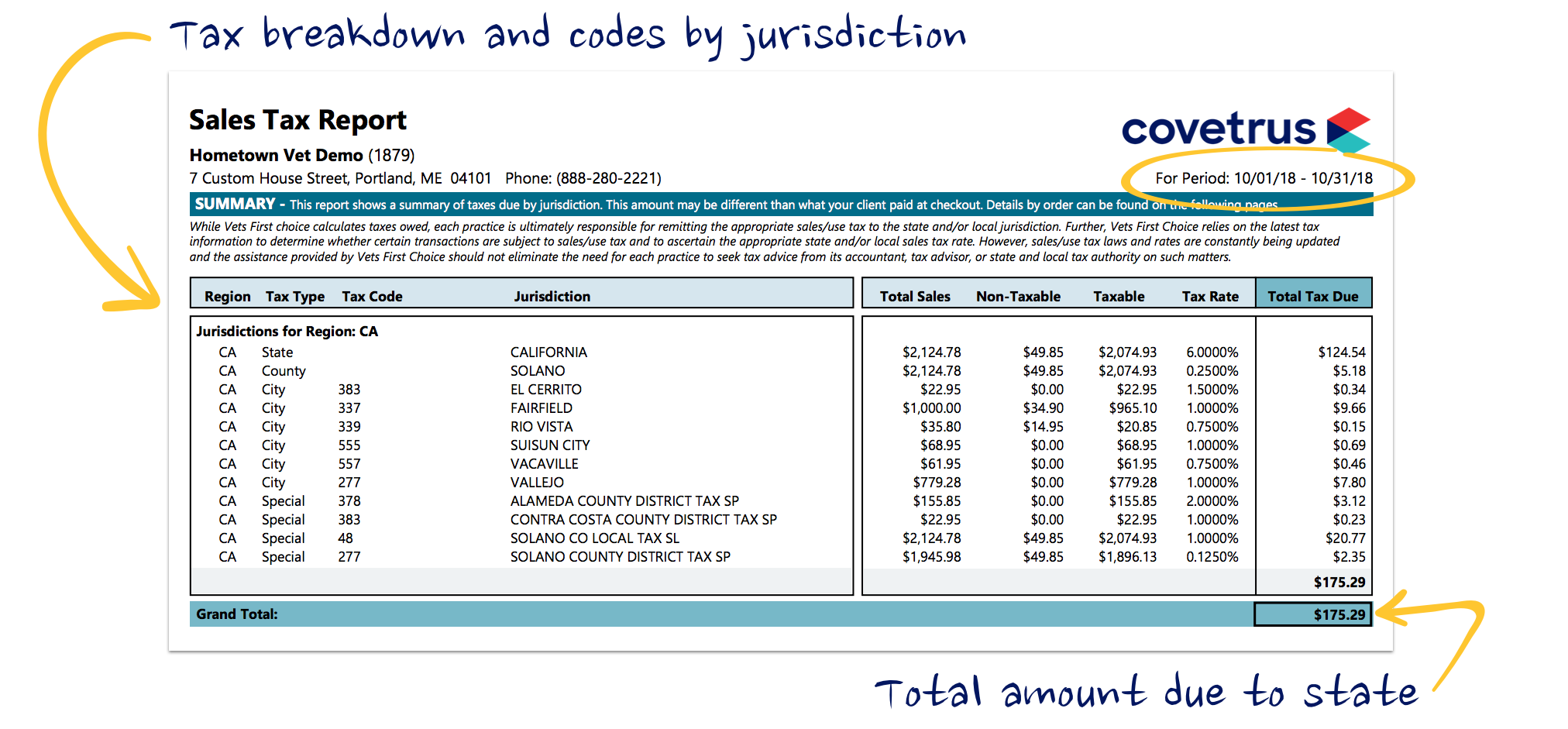

The minimum combined 2022 sales tax rate for Anaheim California is.

. 2020 rates included for use while preparing your income tax deduction. Its sales tax from 595 percent to 61 percent in April 2019. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

65 100 0065. Maximum Local Sales Tax. The latest sales tax rates for cities in California CA state.

US Sales Tax. This is the total of state county and city sales tax rates. Divide tax percentage by 100.

You can print a 775. The calculator can also find the amount of tax included in a gross purchase. California sales tax details.

The base state sales tax rate in California is 6. To Sunday November 13 300 am Pacific timeWe. There is no applicable city tax.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Anaheim CA. 100 N Tustin Ave Anaheim CA 92807 2210000 MLS AR22123773 Huge lot located on major street in Anaheim. Sales Tax Calculator in Anaheim CA.

Local tax rates in California range from. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Calculator for Sales Tax in the Anaheim incorporated.

Rates include state county and city taxes. The California state sales tax rate is 725. Due to scheduled maintenance credit card services may experience short delays from Saturday November 12 1100 pm.

Usually the vendor collects the sales tax from the consumer as the consumer makes. The California sales tax rate is currently. Maximum Possible Sales Tax.

Multiply price by decimal. Texas State Sales Tax. 1837 W Cerritos Ave Anaheim CA 92804 875000 MLS IV22201175 Welcome to 1837 W.

Those district tax rates range from 010 to. Counties cities and districts impose their own local taxes. The current total local sales tax rate in Anaheim CA is 7750.

You can print a 775. There is base sales tax by California. The 775 sales tax rate in anaheim consists of 6 puerto rico state sales tax 025 orange county sales tax and 15 special tax.

The December 2020 total local sales tax rate was also 7750. Method to calculate Anaheim sales tax in 2021. The 775 sales tax rate in Anaheim consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax.

Located in a highly desired. Sales tax rates differ by state but sales tax bases also impact how. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725.

Average Local State Sales Tax. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The price of the coffee maker is 70 and your state sales tax is 65.

The 775 sales tax rate in Anaheim consists of 6 Puerto Rico state sales tax 025 Orange County sales tax and 15 Special tax. List price is 90 and tax percentage is 65. There is no applicable city tax.

The statewide tax rate is 725. This rate is made up of a base rate of 6 plus California adds a mandatory local rate of 125 that goes directly to city. State and Local Sales Tax Rates 2020.

5 Sales Tax Calculator Template

Is Clothing Taxable In California Taxjar

Understanding California S Property Taxes

What You Need To Know About California Sales Tax Smartasset

How To File And Pay Sales Tax In California Taxvalet

Avatax Sales Tax Calculation Software Avalara

California Income Tax Calculator Smartasset

2 Opening Day Tickets Anaheim Angels Texas Rangers Section 131 Ebay

Pre Owned Cars Trucks Suvs In Anaheim Ca

How To Calculate California Sales Tax 11 Steps With Pictures

Ford Dealership Anaheim Ca Ford Sales Specials Service Autonation Ford Tustin

Where Do Homeowners Stay In Their Homes The Longest The New York Times

/https://s3.amazonaws.com/lmbucket0/media/business/santa-ana-canyon-roosevelt-478D-1-eRnG75K4aFdaCPXbjKIKC2g4uUtXvPdrDvU9ktDMbEo.c1885c139eca.jpg)

T Mobile Santa Ana Canyon Roosevelt Anaheim Ca

The Anaheim Hotel Anaheim Ca 1700 South Harbor 92802

Orange County Ca Property Tax Calculator Smartasset

Efilesalestax Com Earns Top Honor In 2009 Reader S Choice Awards